Oxide's $100M Series B

Craig and Giarc actually have a third friend. I just don't remember his name.

Bryan Cantrill:I learned it from You're going into the Tomax and Xamot?

Adam Leventhal:There's a there's a third twin? There was a triplet? Third. Yeah. Lost at birth triplet.

Adam Leventhal:Yeah. Yeah.

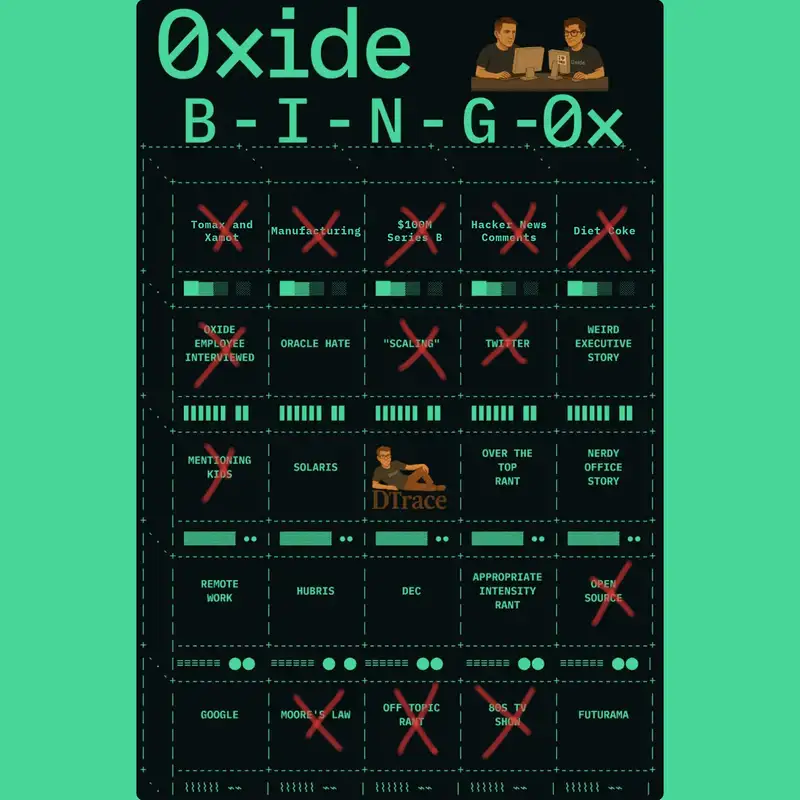

Bryan Cantrill:There there's gotta be some GI Joe fanfic about the the the the triplet, the Tomax and Zamot triplet. And where's that on your fancy bingo card, by the way, mister bingo card? Where is Tomax and Zamot on your bingo card? To fax and z and g and GI Joe Fanfic.

Adam Leventhal:Good. I'm glad you brought this up. Because because can we agree? Like, $100,000,000,000. Like, that's great.

Adam Leventhal:And we're gonna talk about that plenty. But getting getting our own customized bingo card app?

Bryan Cantrill:Come on. No. That that that we are things that Yes. Money cannot

Adam Leventhal:I mean

Bryan Cantrill:There are things that money cannot buy.

Adam Leventhal:Presumably, money could have bought that, but I'm I'm speculating.

Bryan Cantrill:No. I mean, there but there are things that money can't buy. I don't know. I don't I can't name any off the top of my head, but I'm Yeah. Exactly.

Bryan Cantrill:Abstract. Yeah.

Adam Leventhal:No. It's true. I agree with you in the abstract. Absolutely.

Bryan Cantrill:Where's our boss? Is he here?

Adam Leventhal:Did you not okay. He is allegedly calling from the car. I

Bryan Cantrill:No. I told him to download the Discord Discord app. This is not that complicated.

Adam Leventhal:Yes. Oh, you mean, like, where is he? I told him to be here. Yes. Oh, there

Bryan Cantrill:he is. There he is. Man with Legend.

Adam Leventhal:Yeah. Our

Bryan Cantrill:boss. Steve, how are you? Looking for mute. Not finding it. Well, I'll tell you I'll tell you what a $100,000,000 can't buy.

Bryan Cantrill:The mute button.

Steve Tuck:Yeah. You know what? I'm not even gonna describe what I've been fighting because it's just a self own. So but, if it works now, it works. I'll take it.

Bryan Cantrill:It works. And then and that's all that matters. Exactly. And and, again, I think, Steve, I'm not sure if you saw the, not just the Oxide and Friends bingo card, but the Oxide and Friends bingo card generator app that was made. What?

Bryan Cantrill:I Yes. Oh, yeah. Yeah. It's good. And we're already, I I think we're we're already crossing

Adam Leventhal:off I feel like eight people are already shutting bingo right now. Yeah.

Bryan Cantrill:Exactly. That's right. I mean, audio problems are one of the center square. Yeah. Exactly.

Bryan Cantrill:Audio problems in the center square. But

Adam Leventhal:Yeah. Yeah. Let's keep going.

Bryan Cantrill:Hey. It's good to be back, first of all. Were on a little to back. Little little summer vacation.

Adam Leventhal:Yeah. It's

Bryan Cantrill:nice to nice to nice to be back. Nice to be back kind of in full strength here. And back with some big news. We we raised a bunch of dough, which is Yeah. Very exciting.

Bryan Cantrill:Very exciting. We didn't just raise the bunch of dough. We announced that we raised a bunch of dough. So there actually, that's a something I I mean, we didn't also raise it just to

Steve Tuck:be clear, not to alarm. We did also

Bryan Cantrill:raise it.

Steve Tuck:Yeah. No. I mean

Bryan Cantrill:You know what? I guess that I I guess that well, actually, was so one of the things that was kind of funny here is that there are there's regulatory compliance when you raise a bunch of money. And, you know, that regulatory so there are people that namely people that wanna sell you things that sit on these kind of EDGAR filings. And so what was it, Steve? Maybe ten days ago, one could have seen that that we had had raised money because of the and I and I guess, Steve, they walked you through I mean, because companies do this that that wish to not disclose that they've raised money.

Bryan Cantrill:There are things that you can do that are basically shady to avoid this. Right? You can, like, file in states versus filing federally. What what are the some of the things

Steve Tuck:that's worth pointing When we raised our series a, our legal counsel informed us that you have this filing you must do within, ten days that is no it's it's giving kind of a filing with the federal government that you have raised money, and there are, ways that companies will file differently so that that is harder to find. So you you can file state by state, and that is, I guess, harder for these people that sit on these things to discover. And the reason companies try to do this is because they wanna make an announcement, and they don't want people to kinda end run it and publish it before they can make some sort of a splash. And folks will go so far as to just ignore the requirements from the SEC, and hope that, you know, it's it's just a it gets overlooked. And so we were facing this choice in this.

Steve Tuck:Yeah. Not really our speed. So for the series a, there I remember, you know, it was, 2022, and they're like, yeah. I mean, you know, you know, a lot of people aren't necessarily following this strictly. So what do you guys wanna do?

Steve Tuck:And we're like, I think we wanna follow this pretty strictly. And then, and then, again, for this raise, you know, I guess lawyers are always want to sort of lay out all the choices. And and they said again, you can, you know but they advised that folks are now paying much closer attention to following this strictly. We were never gonna do anything different, but it was it it it definitely what what happens is a bunch of people start emailing you and, trying to do business with you, trying to loan you money, etcetera. That is evidence that the raise is out there.

Steve Tuck:Yeah.

Bryan Cantrill:I mean, Steve, I think you probably learned that the Edgar filing had hit the same time I learned because my phone number my phone started ringing. I mean, literally, with people that wanna sell you all the things that they wanna sell the a series. I love the people that wanna sell you PR services after you've announced the raise. There's a the the it's like also, oxide.com. We're not interested.

Bryan Cantrill:We're not interested. I Steve, you'd be getting another

Steve Tuck:one this morning. Oh, yeah. Of course. Oh my gosh.

Bryan Cantrill:And so, Steve, we're telling the story of oxide.com because we looked into oxide.com in 2019. And Yep. My recollection was we found kind of a domain broker who could go approach the owner of oxide. Oxide.com has been sat on and fallow for twenty years or whatever. It's never been anything to the best of my knowledge.

Bryan Cantrill:Unlike verb.com, Adam.

Adam Leventhal:Yes.

Bryan Cantrill:I feel like I now now I feel like a I I feel an obligation to hit some of the more esoteric things with squares.

Adam Leventhal:To fill out the bingo card. Yeah. For sure.

Bryan Cantrill:Bingo card. I mean, surely, this is, like, this is a true Fishworks deep poll. Steve, the Fishworks office used to be the office of verb.com.

Adam Leventhal:Okay. But how do we know this?

Bryan Cantrill:Adam, I'm we're not making it up. Right? That now that sounds like such a .com hallucination.

Adam Leventhal:But

Bryan Cantrill:we would get our mail.

Adam Leventhal:Right? No. No. Not only would we get their mail, we would get their mail. And some vendor, I think it was, like, Verizon, had, like, some massive credit with them.

Adam Leventhal:Like, owed them $6,000. Right. And I can't even estimate how much time we spent trying to war game out how we could get that $6,000. Like, I called them at some point. Like, on speakerphone, everyone, like, huddled around being like, yes.

Adam Leventhal:I am verb.com. Please send me a check.

Bryan Cantrill:Hold on. Let me pass you to my boss, mister Verb. Yeah. We I that is right. Right?

Bryan Cantrill:We it was kind of a I mean, it was it was it had this kind of, like, this caper at where we had to pull off that we were verb.com. It is amazing. That is the kind of thing that we would hallucinate for ourselves, but that actually happened.

Adam Leventhal:Yes. Yes.

Bryan Cantrill:So and then we could also part of the problem when your name is verb.com, I would love to know literally anything about verb.com, the company. It it's un Googleable. Verb

Adam Leventhal:I is

Bryan Cantrill:mean, this this is not a surprise, but Verb is un Googleable. So we Steve, we we approached the the domainbrokerapproach.com. And what is the number that you remember? I want to try to like, if I exaggerated this number in

Steve Tuck:$400,000.

Bryan Cantrill:That okay. I've not exaggerated. That's with my memory too. It's 400 k. They wanted 400 k.

Bryan Cantrill:And as I recall, like, we were told a good opening offer was, like, 200 k.

Steve Tuck:That's right.

Bryan Cantrill:And which like

Steve Tuck:Which was about which was about a $195,000 more than we were prepared to pay.

Adam Leventhal:You're a 199? 999? Yeah. Exactly.

Bryan Cantrill:Yeah. I mean, we we ended up so we ended up getting oxidecomputer.com for $9.99. And I swear oxide.computer, we got that for, like, 99¢.

Steve Tuck:That's right. That was a GB. That was a GB. Did you see the did you see the post on the dot computer explosion, on the back of the Raze announcement, and now's your chance to land grab dot computer out there?

Bryan Cantrill:I you know what I've I've often said that success teaches you nothing? And I love the idea that the owner of the dot computer TLD is now it's like, no. It is the fact that they call themselves dot computer. Look. They raised this $100,000,000 series b

Adam Leventhal:On the back of that u yeah. Domain. And

Bryan Cantrill:so you and and, Steve, I'll let you on the on the punch line, What name is completely available right now? Did you read to the end?

Steve Tuck:Oh, no. Oh, no.

Bryan Cantrill:You the you the drop. No. The drop is like, and folks, hardware.computer is available for the next $100,000,000 series b company. You're like, do not name your company hardware.computer. I always maybe

Adam Leventhal:Talk about on Googleable.

Bryan Cantrill:Talking about googleable from the makers of verb.com. Yeah. Verb the verb.com has finally gone hard tech with hardware.computer. All ungoogleable. So, yeah, that already we've Right got

Steve Tuck:you wanna this entire corner of the economy, you have the island of the country of Anguilla, Anguilla, however, however you wanna pronounce it, that has done 25% of their, of the GDP is on .ai domains.

Bryan Cantrill:Good for them.

Adam Leventhal:Hey. Let's Good for them.

Bryan Cantrill:Good for them. Hey. I mean, they're crushed. I yeah. Absolutely.

Bryan Cantrill:That's absolutely. And oxide.ai, what I mean, have we not registered that? So the We we

Steve Tuck:we in that country as soon as this round went through. So, yes, we are .ai. That's a joke.

Bryan Cantrill:Is it a joke?

Steve Tuck:Gosh. I'm

Bryan Cantrill:Should probably clarify Yeah. Yeah. Should should have let that one hang for another second or two because it definitely, yeah, had me chomping down on it.

Adam Leventhal:I'm like, what?

Steve Tuck:Yeah. No. But the it it did you did you check to see if the same domain break broker was the guy who came back inbound this week from 2019?

Bryan Cantrill:I I did not. I mean, I you must have been like, I wanna reply to this guy and explain to them. It's like, you know, your opportunity to sell us this domain name was in 2019 and admittedly for $10. But I am I am tempted to reply because it's like it's kind of annoying at this point. Because they're hitting me I'm sure they're hitting you up too on LinkedIn and everywhere.

Bryan Cantrill:Mail. I'm getting texts. It's like, alright. Jesus Christ. No.

Bryan Cantrill:No. We don't want We're we the one we did look at buying seriously was 0xi dot d e. Adam, was that was that your idea? No. But you you guys

Adam Leventhal:at Joiant had n0. D e.

Bryan Cantrill:D e. We had n0. D e. Yeah.

Adam Leventhal:And I thought that was terrific. And when I told you, I thought that that was terrific. You're like, yeah, it's fine.

Bryan Cantrill:Yeah. It's kinda fun. It's kinda okay about it. And 0 x I dot de, I think they wanted Steve. They wanted something much more reasonable, but I think it was like 5,000 or €10,000, something like that.

Bryan Cantrill:And we're like

Adam Leventhal:Too much.

Bryan Cantrill:Meh. Yeah. Meh. Too much. We're we're we're gonna go with oxide.computer.

Bryan Cantrill:And I'd like to say the domain name has not been a problem. Also, it has not made the company. So the contrary to the blog entry about the the the power of the dot computer TLD. So we so that that all started to happen. We've got and kind of so much like, you would think that, like, god, the number of recruiters that contact us are like, know, I've got a candidate for you.

Bryan Cantrill:It's like, you know, we haven't we shot our mouths off enough about the way we hire? Like, do how much more do we need to say? But it's like, it doesn't matter what you say.

Adam Leventhal:Are you starting to get I I I actually even got some of that spam, and it's getting highly tailored. Like, I think LLMs are a huge boon for for those kinds of spammers. It's not just the form letter, but it's something highly customized based on content that we've produced.

Bryan Cantrill:Oh, interesting. And it well, I mean, it it based I mean, it's interesting. The first recruiter that says, like, I've got someone that's got great materials that they'd like to submit. Okay. Okay.

Bryan Cantrill:Okay. Alright. Now you've done your homework.

Adam Leventhal:Yeah.

Bryan Cantrill:The and so my I mean, Steve, I can only imagine what your LinkedIn has done because mine has gone has become a little challenging with people trying to sell me products and services. If you are connecting to me and and and we have and we have any connection whatsoever, even if it's just like, I'm a fan of oxide, if you could please attach a note, that would be great. That makes a big difference when you attach a note and offer some context.

Adam Leventhal:Speaking of context. Yeah. You mentioned that we raised some money. Do wanna talk about that? Like, do wanna talk about, like, what we raised and from whom we raised?

Adam Leventhal:Yeah. Down in the blog post, but I thought it'd be fun to repeat.

Bryan Cantrill:Yeah. Steve, go for it.

Steve Tuck:Yeah. So obviously the headline that we raised a $100,000,000, we were very, very fortunate to and and I think kinda kinda coming into this, it it may be fair backdrop just to describe how we were thinking about the next capital raise of the company, because at every step we've wanted to both make sure that we were properly capitalized so we could invest in the right areas of the business, but not getting out too far ahead of ourselves. And again, through 2024, we were really focused on getting repeatable processes around how we build the product, how we ship the product, standing it up in customer environments, getting a good cadence of software releases, getting a good cadence of customer installs and then expansion projects. And we felt like we were at a good place where it made sense to then go do the next fundraise and capitalize the company for what would hopefully be the next three or four years at minimum. And when we started talking to prospective investors, there there was a a subset of them that had been doing their homework.

Steve Tuck:I mean, had which I know should sound like it is minimum entry to being in the the venture capital space and engaging seriously with prospective portfolio companies. But these firms had clearly been spending time following oxide, getting to know who we were, doing their own research in the field with companies that could be potential customers. And when when, you know, in particular, when we met USIT for the first time, they knew a hell of a lot more about Oxide than we would have expected, kind of any investor. But in particular, had really done their homework. Like, really both in in researching Oxide, but also, again, kind of in the markets.

Steve Tuck:And so I don't know, Brian, what your take was, but I think when we first sat down with them, it was it was unlike many a first VC meeting that we had had previously.

Bryan Cantrill:Totally. And it's worth mentioning too, maybe Adam just said a little I know I know you don't like it when we provide additional context, but the the so we were raising we had raised a series so you've mentioned you we'd raised series a. So the first capital into the company was called the seed round. You know, this gets there's been this kind of ridiculous do you call it inflation or deflation, Adam, when you've got pre seeds and pre pre seeds and all these, like, different modifiers on seeds? But I think for us, the first capital in was a seed round.

Bryan Cantrill:It's called a price round, which which set a valuation for the company. We then raised a series a, which is a price round, and set a new valuation for the company. And so we were Steve, I think when we met USIT, we were definitely we were not raising, and we had raised our a. But when you're, you know, when you're a VC funded VC backed company, you always need to pay some attention to what the the milestones are for that next raise. And when you know, if a firm wants to get to know you, you generally would want to get to know them.

Bryan Cantrill:Because I think one of the things that, you know, we have learned is that when the it takes a while for anyone to make an investment and to get conviction in any company, but especially Oxide. We're we're very contrarian in many ways. There's a lot to get to know. And so we're pretty biased on getting to know folks over a protracted period of time. And, Steve, I dare say, like, the investors that we actually really like have that same disposition about portfolio companies about wanting to get to know them for some extended period of time.

Bryan Cantrill:And

Steve Tuck:But but I would say, I mean and and yes. And, want to get to know companies for an extended period of time and also want to do the work of getting to know the company without it only being through the company.

Bryan Cantrill:That's right.

Steve Tuck:And that takes real work and it turns out. And when you have investors that are truly curious and do real work in researching everything that surrounds the company that they're thinking about and also the company themselves, you get to fast forward to much deeper, better conversations faster, which Totally. You know, definitely been the hallmark of the of the investors that we have had on the cap table and then certainly, new ones that we're adding.

Bryan Cantrill:And I think, Steve, it's also always like the second meeting that is that is I mean, the first meeting is definitely interesting, but you're just getting to know folks and you don't okay. Like, and you're giving them context. You're learning more context. For me, for USIT, it was that second meeting that really stood out, in part because, one that was the first time I think we met Liz with Stein.

Adam Leventhal:And Yeah.

Bryan Cantrill:I think it was between Liz and Kevin Guitano. I just remember the five of us all gathered around the the the John von Neumann statuette from Brian that the listener of the pod. I mean, reference to a previous episode on on our I think it's the Lip Bu Tan episode. Mhmm. The where we talked about the statuette and the exactly.

Bryan Cantrill:The bigger card activated. The but just the fact that you have VCs that recognize who John von Neumann is. I mean, this is and, Steve, it reminded me of when we were first raising and we were I think out of frustration when we encountered Eclipse, it just felt like oxygen because we actually had peep finally had VCs that understood, like, computers at all. And I remember joking to them that we had thought that we wanted to make it a prerequisite of anyone that spoke with that they could name the CEOs of Intel and AMD. And at the at the time, Lisa Hsu and the much more forgettable Bob Swan, the the Millard Fillmore of of Intel.

Bryan Cantrill:And I remember Lior saying that Lior Susan at at Eclipse saying back, if that's your constraint, like, you'll be raising only from Eclipse. Like, you're basically, we I can tell you that, like, VCs are not gonna be able to name the CEO. Which which

Steve Tuck:remember which in fairness, we

Adam Leventhal:had we had we had we had learned

Steve Tuck:as much spending a couple of weeks on Sandhill before that meeting. Like Yes. It it was it was definitely, know, we we would spend most meetings describing the importance of building both hardware and software together in holistic products for big industries. And with that meeting in Eclipse within like, what, a minute and a half, they stopped us.

Bryan Cantrill:Oh, yeah. And they were

Steve Tuck:like, yeah. Sorry. We 23 of the world's 25 most valuable companies do hardware and software. You definitely don't need to make that case here. Like, oh, okay.

Steve Tuck:We're home.

Bryan Cantrill:But in terms of, like, when you have a race like this, you know, it's a long kind of courtship, frankly, where you're just getting to know one another and we really I mean, I thought that second meeting, at least for me, Steve, was where you really began to see you know? Because it was very clear they had just done a lot of homework between meeting one and meeting two. And, you know, I felt like every time we met them, we had it was like, wow. This is, like, this is more and more interesting. And I think that the feeling from for them was was mutual.

Bryan Cantrill:And then, you know, we began you you begin to get into talks about, like, what does a future financing round look like? And I think one of the things that we really liked about them because we we weren't raising. Right? We didn't actually you know, we didn't do the Sandhill shuffle and line up everybody and over a, you know, kind of a two week span where you've got two meetings a day, three meetings a day. And you can run a process like that for sure, and that's what we would have done.

Bryan Cantrill:But boy, if you've got the right investor that gets to know you and wants to I mean, calling it a preemption is a little strong, but basically wants to has a vision for what the company should do and is willing to get a term sheet behind it. It's awfully tempting. And for USIT, the more we got to know them and the more they got to know us. And then I also like the fact that they have really big aspirations for us as a company, which is great. They share our aspirations, and really see the capacity for this to be the kind of company that we believe it can't be.

Bryan Cantrill:And that that kind of reflected in, you know, they wanted us to they're like, hey. We think you should go big here on the series b, and it's and it was it's great. So that's how we that's how we

Steve Tuck:ended up. We were we were thinking about a smaller number. And I think, you know, normally, sure. If a if a VC is like, oh, we think you should raise more. You're like, well, yeah, of course.

Steve Tuck:You have a bunch of capital you're trying to put to work. In their case, it was, we feel it's important that you have sufficient capital for the following reasons. And they walked through the same kinds of things that we had been thinking about internally for areas of investment that we need to go make. And so it was definitely a much more rigorous thought process, well informed. They had done their homework, and it it bode well for for what would be our lead in the series b.

Steve Tuck:Yeah.

Adam Leventhal:Brian, in in the blog post, you talked about USAT asking great questions. And a few folks have asked, what were those questions? What kinds of things were they asking about that was so differentiating?

Bryan Cantrill:Yeah. I first of all, I love that question. I love the fact that people are observing that we because I the reality is a lot of firms don't ask great questions. And, you know, it's one of the big changes in VC. It used to be, you know, a generation ago that all venture capitalists had been entrepreneurs.

Bryan Cantrill:So they'd all been on kinda our side of the table. And over time, as venture kinda became its own, you know, maybe you could say that that that venture started to stand on its own two feet, but became its own domain. You have an increasing number of VCs that have never actually been on the other side of the table. And I think that there's got you know, there there are pluses and minuses to that. But one of the just consequences of that is that VCs don't realize what other firms ask.

Bryan Cantrill:And what's really interesting is that there's they don't all ask the same caliber of questions by far. And often when you are getting first of all, I mean, Steve, love to hear your perspective on this. But from my perspective, when someone says I've got a technical question for you, that's like bad question alert. It is just the that's just an indicator that it's like this is gonna be someone playing gotcha or someone who wants to show you how much they know or someone who wants you to acknowledge how much they know or someone who wants to remind you that I was technical once or I and so, like, the questions that are prefaced by I've got a technical question, first of all, are not that technical at all and are often not very good questions. The questions that are often very good, at least at that kind of surface area, that kind of first level of questions are when folks I've got kind of a dumb question for you.

Bryan Cantrill:That's like a okay. Good question alert. That's like a you you you you've got because you've got someone there's a little bit like someone is kind of revealing their own disposition. And if someone's saying that saying, I've got a dumb question for you, there's a degree to which they're saying, like, I'm curious about this domain. I'm trying I'm like, I'm learning more about this domain.

Bryan Cantrill:I'm not trying to show you how much I know. I'm I'm trying to learn more. And I always found that, like, the questions that they would ask would get really, really interesting. And there were certainly some questions in that category of questions that were not even, like, phrases. Like, I've got a dumb question, naive question for you, but are were, like, simple questions that reveal real depth.

Bryan Cantrill:There are a handful that I'm sure Steve and I can ping pong on the ones we can think of completely. I'll give you one that I can that that is a simple question, relatively speaking, that USIT is the only firm to ask about, which is, hey. You're doing hardware and software co design, which we think is great. How talk to me about the mechanics of getting hardware engineers and software engineers to really work together. What does that really look like at the kind of the mechanical and organizational level?

Bryan Cantrill:Which I think is a great question. And there's a lot we can talk about. And, you know, we I I think many of our answers pointed to podcast episodes. We we need, like, an in office drive.

Steve Tuck:Oh, are you are you saying not everyone did? Because I think it might have been everyone.

Bryan Cantrill:I think it might have been everyone. We we but it's which is great, like, that you can be able to say, hey. Listen. Like, here's the and and we would often point people to to different podcasts. But that to me is a a concrete question that USIT USIT is the only firm to ask that.

Bryan Cantrill:And it led to a really fruitful discussion and I think a real appreciation for the the the team that we built and kinda how we constructed things, that they appreciated and I appreciated. But I've got other examples too, but I wanna get Yeah.

Steve Tuck:I mean, there were were definitely definitely a couple that that caught us by surprise. Just at the level of depth and rigor, I think maybe just at a high level, one of the ones that I liked that was not just a bullseye shot to some implementation detail in the product As I remember, they were asking about how we think about the tension of or just the motion of vertical integration, how far to vertically integrate the system, and partnerships, technology partnerships that we make. And it's a very good and a question that led to a bunch of good discussion because we definitely highly value our technology partners that we are building with and around, and then also want to make sure we are delivering a complete system and experience to the end customer. So part of those relationships are making sure that we're all working together in service of a complete product that makes it easy for customers. But anyway, that was one that we had not that folks had had not we just hadn't had as good an in-depth discussion around.

Steve Tuck:I remember, like, man, some of the some of the at depth were around our next gen switch we're building, which is, I'm sure, one on your on your

Bryan Cantrill:bingo card. For sure. Absolutely on my bingo card. Yeah. This was this was uncanny, I think, too, this question.

Bryan Cantrill:Yeah. But go ahead.

Steve Tuck:Well, we mean, just as as the setup, we had, of course, built our our first generation of switch in the oxide rack product is based on Tofino. The Tofino two chip from Barefoot, then acquired by Intel, then a casualty of Intel leadership, RIP Pat, and

Bryan Cantrill:Oh god, Daiko almost came out my nose. Sorry.

Steve Tuck:As we had a bit of foresight, not anywhere near as much as any customer should, of a product that a major company is providing, we ensured we had built up a big inventory of FeNO parts so that we can continue to manufacture and sell hundreds and hundreds and hundreds and thousands. We years and years of runway on that product line. And in the meantime, we are building our next generation switch that we've talked about here on the podcast based on the X2 part from XSight. And in conversation with XSight, among the things that we really liked, their affinity towards programmability and lots of technical value in the part itself, a bunch of cultural alignment, values alignment. But one of the things that we struggled with, one of a couple things we struggled with with Intel around the Defino part, was being able to get that lower level software so we had a better way to reason about the part when it's in service and trying to figure out what's happening in those lower layers of the part.

Steve Tuck:But Intel had their claws around that lower level IP and felt that exposing any information about that was going to compromise their competitiveness. So that was always a point of friction. It's like we we can can only only do so much about what we could see and then have to infer about what was happening at lower levels of software in chip. And so one of the things that was really important to us, an opportunity with the X Lite team, was to open up those lower layers, starting with the ISA, the instruction set architecture. And so we had been discussing that with Xcite, and I think Xcite was equally excited about being able to lean into an open architecture, which makes it easier for people to build on and just helps to get much more reach leaning into openness, not away from it in fear of competition.

Steve Tuck:And then I think it was kind of in the midst of that. I mean, we had we had announced the XSight had announced opening up the ISA, and then USIT came in with this dark shooter question.

Bryan Cantrill:Well, they they asked specifically about, like, okay. You've got, like, the instruction set architecture. Right? That's open. What about the control registers?

Bryan Cantrill:Do you have access to the control registers? And that's a very sharp question.

Adam Leventhal:That is a technical question. They can prefix that with this is a technical question because it's enormously technical.

Bryan Cantrill:You I also, the best technical questions are not prefixed with this is a technical question. Kinda like, you know, it's like, you don't need to, like, hey. This is a funny joke. It's like, this is not a funny joke. Yeah.

Bryan Cantrill:Know? And and it's no. That was not prefixed with this is a technical question. That was just more like a kill shot. And we were like, are you what?

Bryan Cantrill:And, actually, Steve, remember you and I were both like, we have put this in the board deck somewhere because they got our Or or

Steve Tuck:else done or the the building is bugged.

Bryan Cantrill:Yeah. Because this is an issue that had been a real issue of concern for us and about the getting access to the control. And and the reasons is why is this important? So a switch, you've got it, and and we, fortunately, we're very excited that XSight has opened their x two ISO, which is great. So you can get the full instruction set architecture.

Bryan Cantrill:It's also very important you can get access to the actual control or just the device itself because those control registers, are that that's how you what you need in order to make your own true runtime and then be able to deploy all the software in the switch. The reason that it's very hard to get to those kind of control registers is because there's often third party IP that can be there that can be that you don't want to expose as necessarily an abstraction. So that's tricky. And, we we've been kind of going back and forth with XSight about getting the information that we need to go build the software that we need. And as we're going back and forth with them over this, we get this question from USIT.

Bryan Cantrill:And I was just like, we have they they must be echoing this back to us somewhere. Somewhere in the material that we have, we have highlighted this as a risk. Because, Steve, I think you we try to be pretty good about highlighting genuine risks at the board level and felt like a genuine risk. But then you and I both moved to the board deck. It's like, we did not mention this.

Bryan Cantrill:So where are they getting this from? And as it turns out, when, you know, we had the pleasure of meeting the technologist, they had engaged due due diligence and asked him, like, where did you get this from? He's like, oh, I just know that this is a problem. Like, I've I've you know, having you know, I he he's his career has been in semis, and he's like, I just know this is a real issue. And I wondered how you were you know, I just wanted to make sure that you had the access that you needed to go build this thing.

Bryan Cantrill:So it's just like a well informed, very good question. And, also, you know, it was also in kind of the spirit of that question was not to to it was not this kind of, like, head butting kind of spirit of trying, you know Yeah. Trying to dominate us or what have you. It was really in the, like, I just wanna make sure that this is something that you've thought about and that you're on. And, of course, we thought about it a lot, and I think they were more than satisfied with the answer they got.

Bryan Cantrill:In part because we do have all the we actually do have all that access that we did.

Steve Tuck:I think and and then, you know, like, you know, 65 questions sort of in between the highest levels down to the the the really detailed. And it just gives you you you and because the other side of this that that we haven't spoken about is that you're having a bunch of conversations with a bunch of interested investors. And all of which are trying to preserve optionality because that is their job, is to give themselves an option to invest all the way up into a point in which they decide not to. And you will have to spend time with those that will want to act as if they are deeply aligned and long term thinkers and they are going to be good operating partners as you go forward. And it turns out a bunch of them are like, yeah.

Steve Tuck:And can you, you know, do you have one more enterprise deal you can share or 10 or a 100? Or, well, if I could just get one more x, then I can get this other partner over the line. And when meet someone like the crew at USIT, you're just like, okay, actually, the entire thrust of the conversation is how do we be prepared for the next phase of the company three years from now? Because these questions are coming from a place as if one were sitting in our seats going, okay, what are the things that can kill us in the next twelve months and then twenty four and then thirty six? And then to really attack five years thereafter, what's all the foundation that we have to have in place?

Steve Tuck:And none of that's gonna be explicit, but just in the the tone and the type of the questions and conversation, suffice it to say, we were we were getting more and more excited about potentially partnering with USIT.

Bryan Cantrill:Well, I guess the other thing that I really appreciated, Steve, we had USIT out for you know, as as things are kind of advancing and they are getting more and more interested, they're asking broader and broader questions, and we're wanting to to have them go more and more depth with the company. And we had them meet a big cross section of the team. And one of the things that I really loved is their interest in meeting the team. And we just had everyone we we actually wanted to introduce everyone, and we actually Adam, you were there. We wanted to, like, just have everyone inter like, introduce who they were and why they were at Oxide.

Bryan Cantrill:And it was extraordinary. And it was I think they came away really appreciating this has been always true for them. This is not true. You would think that every VC firm would really care about team composition and would want to get to know the team. Most don't.

Bryan Cantrill:They just they kind of like they wanna talk to, you know, the CEO, and then they kind of will draw their conclusions about the team from that. Then we shouldn't. They should get to know the actual team, and they really USIT really did, which was great.

Steve Tuck:Yeah. I think everyone everyone sort of took the opportunity to introduce themselves and went around giving a, you know, a minute or two of sort of why they came to Oxide, which was unprompted. Although I think by the end of it, USA team might have been like that was well orchestrated and well prompted, Oxide team. But it was a great usually, we push for shorter introductions in meetings with partners and others, but in this case, it was well worth it.

Bryan Cantrill:Well, I think it was worth it for them to see just kind of the depth that people feel in terms of this company, in terms of why they're here. As an investor, you should be asking this. But again, most don't. And it's another in the class of very good questions that they were asking. So I feel like there were a bunch more where that came from, Adam, but that's a good kind of cross section of some of the very good questions that they were asking.

Adam Leventhal:Yeah. Those are great. We got some other questions, both from Hacker News and social media and Discord. One of the ones that stood out to me, and it's phrased I'll give you the the kind and then the unkind phrasing of it. Adam Thomas is in the chat, said, what are the bottlenecks in oxide that you most want to spend investor money on?

Adam Leventhal:And then someone who will remain nameless on Hacker News, put it much more simply, what do they need so much capital for?

Bryan Cantrill:Listen. Do you think this Diet Coke is gonna buy itself? I mean, come on.

Steve Tuck:Seriously. Liquid death Diet Coke. Well, maybe just in terms of areas of where we have known that we wanted to further invest behind and that we want to go invest in now, Some of the more straightforward ones include being able to keep our lead times from customer order to customer delivery short, even as we are scaling up. And it may sound simple. It's like, oh, well, you just buy more materials and have them lying around.

Steve Tuck:And yes, inventory is important, but actually that part of it you want to do to that person's question, which is a very good question, you don't want to spend equity dollars on materials, especially materials that are in service to a customer's order that is a financeable activity. So when a Fortune 500 company is ordering equipment and you need to buy materials for that equipment, that is often a, that is a purchase that a bank would finance for you at, in in order for you to be able to get a float on the material purchase with a very high confidence that you are going to receive payment on that purchase order from a customer. So you'll hear of lines of credit or debt financing, and you usually want to use a financial services partner for materials inventory that you are buying that is going to go in service to a customer order. But you don't always have a customer order in advance of when you need to buy materials. So for example, we've got 500 different parts in our bill of materials, some with very long lead times, some with very short lead times.

Steve Tuck:And for those that have very long lead times, you do not want to be doing just in time ordering. Even though, yes, from a financial perspective, can get debt financing can cover off on that purchase, You really need to have those materials in advance, or else you could be facing lead times that could extend to I mean, you will you will often find, like, at a particular time, a Cisco switch is on a fifty two week lead time. And we could not find ourselves in that position if we can avoid it. And so in terms of being able to meet scale up of operations and therefore be able to service larger orders from our customers and keep lead times in the band that we want to keep them in, you have investment in things like how many lines you have running at your contract manufacturer, how much real estate you have for assembly of the systems. There's investment to be made in the logistics capabilities and delivery and service and warranty.

Steve Tuck:But I think one of the bigger investments that we want to make is continuing to grow the team in the areas that we need it. That is expanding our engineering team, expanding aspects

Bryan Cantrill:of

Steve Tuck:our operations team. And that is the thing that you want to use equity dollars for. And I'll pause there because there's a a bunch of other places that we wanna go invest. But the I think the to the to the hacker news comment, your goal is not to go spend all the money that you just raised. You want to make sure that you have got a long enough runway to where you can build a sustainable business that is now not running like fundraise to fundraise to fundraise.

Steve Tuck:And we think doing this raise at this level gives us that while at the same time being able to invest in a bunch of important areas that we need so we can deliver better and more service to customers.

Bryan Cantrill:Yeah, that's exactly right. Mean, I think in order to scale, because we, I think, and we've got some questions related to this. We do not have our own manufacturing facility, right? We work with a contract manufacturer. So on the one hand, this is much less capital intensive than people think.

Bryan Cantrill:I think people think hardware and they think like, oh my god, you've got your own manufacturing facility. And it's like, no. There are lots of ways to actually be capital light when you are still making a physical good, especially when it's not a consumer good. But you also need the the war chest to be able to go get favorable terms. And, I mean, all the things you need to be able to do is secure long lead time parts.

Bryan Cantrill:All the things that Steve mentioned, you it's not like that doesn't those are that doesn't cost a $100,000,000, but having that kind of capitalization allows you to go do these things on terms that are really favorable. So you actually do need to raise the capital in order to be able to to be able to scale manufacturing.

Adam Leventhal:Yeah. We have some other questions related to manufacturing. Like, people knew that we were working with Benchmark, and is that gonna continue or expand? And then other questions about international shipping the product international, building the product internationally with some subtext around tariffs. Anything you wanna say about kind of manufacturing expansion, international manufacturing or shipping internationally?

Steve Tuck:Yeah. I think first, big fans of Benchmark Electronics, and we believe they can handle just about any scale we throw at them, which is exciting. Now with any contract manufacturer, it doesn't matter big or small, giving them predictability and giving them forewarning are the best ways in which you can give a partner the best chance of success when scaling up quite a bit. Continuing to be strong partners with Benchmark Electronics, We are definitely focusing on where our customers want us next. We've remained focused on The US market for this first, what is now like eighteen, twenty months in the commercial market.

Steve Tuck:And with a careful eye on where we're seeing a concentration of customer interest, we are seeing interest all over the globe, but there are some markets where there's higher concentration of that that are easier to begin opening up or making oxide products and services available. So you will definitely see oxide available in more and more markets here soon.

Bryan Cantrill:Yeah. And I would say the tension there is we and we've said from the beginning, we absolutely know that a huge chunk of our revenue will be outside The United States in the limit. No question. For a bunch of reasons. Right?

Bryan Cantrill:And I think that we a bunch of the things that we tack into are you know, I think Romich Patchnik called this cloud nationalism. There are a bunch of reasons why people wanna keep things in countries. So there are a bunch of reasons why we'll have customers abroad. But the tension with that is that Steve and I have both lived a company that may have had a slightly reckless international expansion. And if you wanna light a lot of capital on fire, an overly aggressive global expansion is a terrific way to do it.

Bryan Cantrill:And we also don't wanna do that. So that's kind of the what we're the the the needle we're we are trying to thread and always with everything on an eye towards customers. So we are gonna go where we got customer demand. I will say, Steve, one of the things we did do to get ahead of that is we, you know, we had our episode on on getting compliance on Oxide, the chamber of mysteries. There you go.

Bryan Cantrill:Is that a chime? Did that are you crying me about?

Adam Leventhal:Actually, I just picked up my pen and accidentally hit something, but, yeah, just really There you go.

Bryan Cantrill:That that's pretty good. That Yeah. Go analog. Yeah. They're going analog.

Bryan Cantrill:The but we've that was only for compliance in The US. We wanted to make sure that we got compliance in the EU, in Japan, some other important international markets. So we've we've done that recently as well. So there are some things you need to do, some kind of prep work. Need to do it, and that work costs money.

Bryan Cantrill:So this is where that international expansion is get that is very helpful to raise for that international expansion. We're still gonna be careful as we do it, though.

Adam Leventhal:Nice. I think the last time we did an AMA was around the initial product launch. And at the time, I was reminded of the the Passover tradition of the the questions from the wise child and the wicked child and the simple child and the child who does not know how to ask. And I was definitely reminded of that again as I subjected myself to every one of these hacker news comments.

Bryan Cantrill:I can I can I just tell you, I think of this because I learned of the of this Passover tradition from you, Adam, in that episode, and I now think of this whenever I am in hacker news?

Adam Leventhal:I know.

Bryan Cantrill:It feels like it is an evergreen for hacker news.

Adam Leventhal:I know. It's and and so I had I did end up categorizing them this way a little bit, and and I I want to start with I I feel like I actually accidentally started with the wicked child a little bit. But to get back to the simple child, there were a couple of, I thought, good, simple, earnest questions. One of them was what percentage of enterprise IT compute has not moved to the public cloud? And another one is if someone else's software is running the hardware, then what difference does it make if it's on prem or off-site?

Bryan Cantrill:Yeah. That's a good question. Which of those should we I I feel in terms of the the first question, what percentage of enterprise IT compute is not Oodo the ThoughtSpot? Isn't it whatever number you want it to be for whoever you are? I think it's not like a I think it's just not a pick them.

Adam Leventhal:No. No. No. First, you have to launder that kind of desire through a consultancy, and then they come up with the number that you wanted it to be.

Bryan Cantrill:I feel I mean, I think that what we know is there is a lot of enterprise IT that has not moved to the public cloud and is not going to move to the public cloud. It's a very it's significant. I think it's hard to say beyond its significance. And, Steve, I'm sorry. If I'm if I if if if you wanna mute me and actually give me email, we actually have this because I got the number

Adam Leventhal:right We paid a consultant to

Steve Tuck:see Listen. What the number I just got off with Gartner. No.

Bryan Cantrill:That's right.

Adam Leventhal:I think yeah. What we what we

Steve Tuck:have said is contrary to a bunch of popular narrative, it turns out everything is not going to the public cloud. And all you have to do is talk to large enterprise customers, and they will educate you very, very quickly the realities of the broad IT needs that they have. And that where one once may have believed that they might be able to push a whole bunch of stuff to the public cloud, once they got 30% in, 40% in, 50% in, realities set in, which is like, it's great technologically, and it is where I would like to be able to run much, much more of my software. But it is pretty expensive, and I don't have good governance. And and these these are not absolutes.

Steve Tuck:Right? I mean, of course, this is all, these are all nuanced, but it is I am going to have on prem IT for a very long time. And whatever the number is, the other element of this is that 20% of the global economy is on the Internet today, and there's just a whole bunch more coming that is going to run both in the public cloud and on prem. So it's it is a very, very large market that is growing. It was interesting.

Steve Tuck:A reporter was telling us that they'd seen that the trends of purchasing for infrastructure on prem were only growing slightly, and public cloud was growing. Well, If a bunch of stuff was moving out of on prem to the public cloud and it's still growing, that tells you that there is a lot of new being deployed on prem. But to Adam's point of just whatever publication suits your narrative, I think we like to turn to a pretty good expert in this space. And if you listen to Andy Jassy from I think it was theCUBE? It was an interview possibly a re:Invent, big conference recently, and I think it was the end of last year, and he said that 85% of IT infrastructure sits outside the public cloud.

Steve Tuck:Now that is in service to how much AWS's opportunity is.

Bryan Cantrill:Exactly. That's why we should be an $85,000,000,000,000 company.

Steve Tuck:There you go. But no, I mean, reality is it's a lot. If you go to talk

Bryan Cantrill:but but

Steve Tuck:also, And public cloud is super compelling because it helps your business to move faster. I mean, all the no one has to describe the value of public cloud computing these days, which is all the more reason why we felt like you should be able to have that same those same benefits on prem.

Adam Leventhal:You know, this tacks into a comment that I I categorized as wise and says it talks about, you know, DIY, but then at the high end, I think the market is literally infinite. Maybe he means figuratively, but every large company should want this and want it now. Cloud providers are extremely expensive and outside of one outside of the one tier where prices really are outrageous, they perform poorly and often offer little support. This really feels like the future. That was a heartwarming comment.

Bryan Cantrill:Yeah. And I feel actually and that's also that comment is effectively an answer to the other question you raised about, like, if someone else's software is running the hardware, what difference does it make if it's on prem or off-site? And that question is kind of actually only getting at one of the reasons to run on prem, which is this kind of risk management reason. And there are reasons why when you are running on your own physical machine in your own on prem DC, yes, it's very different than running. It's not just the fact that, of course, you're running someone else's software, but it's a big difference when it's operating over an air gap.

Bryan Cantrill:Right? There are a whole bunch of risks you take off the table. But that's only looking at kinda one aspect of running on prem, which is this kind of risk management angle, which is important, but it's not like the only reason. And this other comment, Adam, that you just read gets to this other reason of like, there are big economic reasons. And, Steve, you and I have always believed that the economic drivers is the big one, that the there are when you get to a certain scale, you don't wanna rent all of your compute.

Bryan Cantrill:You wanna own some of it. It's just really the economics of it, and not merely the risk management and some of these other aspects.

Steve Tuck:That's right. And the economics well, and then what what used to be the case is the economics of public cloud were were were a little it was steeper and harder to harder to stomach in certain circumstances. On prem, you at least had cost predictability. And then, of course, along comes Broadcom. And now cost predictability is out the window, and the difficulty for CFOs and CIOs in the public cloud of like, yeah, but I know my number's all over the place, and I'm sorry I can't pin it down, but this is just the realities of public cloud.

Steve Tuck:You now no longer had cost certainty on prem, and that's what is putting folks in a bit of a bind right now trying to figure out how to forecast.

Bryan Cantrill:Well, this is I mean, Broadcom is giving new meaning to the Jeff Bezos quote of your margin is my opportunity. It's like, Bezos is aimed at at competitors. Broadcom is aiming it at its own customers. And there's a degree to which I think one of the frustrations that we have heard from Broadcom customers is like these price hikes aren't gonna end. Like if I could absorb one of these and have total price visibility, but I just feel like there's no and and this is now feeling like I and, Steve, you and I, we we we we got together with a bunch of of of, you know, sampling of folks in IT asking what is the top priority in IT.

Bryan Cantrill:Know, I was actually I don't know what I was praised for. But the the number one issue for everybody was cost containment. And I think because just as Steve mentioned, it used to be that on prem and running VMware kind of gave you that cost containment, and that cost containment is now gone. And people feel like I am desperate for some kind of cost containment. I've got to get this under control.

Bryan Cantrill:And the public cloud, we've heard over and over again about initiatives where people move to the public cloud, especially large entities, and they tap their budget out when they have only done a fraction of their move. And now they're kinda stuck in this hybrid world, and they're realizing that, like, I this is not the public cloud can't be the answer for everything. I love the elasticity. I love the velocity. I love the agility.

Bryan Cantrill:But I I I've gotta get some cost containment, and and I've gotta be able to know how much this thing's gonna cost.

Adam Leventhal:Nice. Let's see. Some of these, I'm I've categorized that wise, I feel like should be properly categorized as wicked. But

Bryan Cantrill:I Yeah. Exactly.

Adam Leventhal:I have I I wrote I wrote down What

Bryan Cantrill:I want is, like, a hacker news feature where instead of, like, uploading something, I can vote something as wise or wicked or simple.

Adam Leventhal:Or or doesn't know how to ask. Yeah.

Bryan Cantrill:Oh, doesn't know how to ask. And I just think that this would be I think it's super helpful. I honestly do think that. I think this is like a great and clearly, I mean, this is coming from, an ancient tradition. I mean, there's like

Steve Tuck:That's right.

Bryan Cantrill:I I just feel that, you know, that there's some there's something very Lindy about this. I you know? And so I think that it's I think I have

Adam Leventhal:to first

Bryan Cantrill:look into it.

Adam Leventhal:So one of these wise slash wicked comments was I was skeptical as well if only because just being a better product isn't enough to win the market. Everything we hear about Oxide seems like an impressive greenfield implementation of a data center, but is it enough? Do people make buying decisions at this scale care if their sys admins have better tools, which I think is a great opportunity. Yeah.

Bryan Cantrill:Yeah. I think it is like a and I think that is a wise and wicked question. Agree. Yeah. Yeah.

Bryan Cantrill:Exactly. And I think that what folks might not realize is that the especially for people that are looking at closely at Oxide, the people making the buying decisions have themselves a lot of experience operating operating in the cloud or operating on prem. And they are I mean, and maybe we're self selecting for the kind of terrific customers. But the kinds of questions that and I you always love it when people ask you a question where you're like, wow. Who hurt you?

Bryan Cantrill:I mean, this is kind of such, you know, a you know, very specific kinds of I mean, only a lot of the decision makers that we're talking to, you can ask them, like, describe a firmware bug that has injured you in the past and you will get an interesting answer. Right? And one could say like, well, that's not okay. But you're like self selecting for nerds. It's like actually, but the nerds are the decision makers in a lot of these companies, and this is more common than not.

Bryan Cantrill:So I think it is and it's not just like the level of you know, because the the the the wise slash quick question asks you, do the people making buying decisions at this scale care if their sysadmits have better tools? It's not merely kind of a quality of life for the people actually operating these systems. It's their ability to scale what they're doing without having to scale their cost. Goes back to that cost containment. Like, how large a team do I need to run this thing?

Bryan Cantrill:Can my is my team gonna have to focus on applying bias updates, or can my team focus on actually delivering the value that we need to deliver to our customers? And people care

Adam Leventhal:a lot about that and a

Bryan Cantrill:lot about bang for the buck and allowing their people to do the things that they need their people to do, not this this kind of toil that you get with the extant on prem stack. Yes, people do care.

Steve Tuck:I mean, your your SREs, their quality of life really, really does matter. But also, so do your developers. And that's an argument that just in the last decade seems to have resonated a lot more at the top of organizations where they actually do care about the folks that are building a lot of the software products and services that customers are building for their own customers. But the one that is definitely growing in importance is security. And it turns out that where it maybe once was the security office was sort of the bad cop that was just there to make sure that people were following proper updates and being able to meet an audit at the end of every month, that the actual systems that a company's important data is running on, that they are more and more looking for systems that can give them confidence about the attestation of those lower level systems.

Steve Tuck:And so I think it is making the lives of SREs, the engineering teams, the CFO, and then and then also the security teams. Like, they're where some of these things were of lesser importance four or five years ago, they certainly have have grown in importance today. And, yeah, it matters.

Adam Leventhal:Yeah. I I feel like every time we have a customer come by the office, someone with a very robust title will end up asking a question way down in the weeds. And I always get the sense, like, they didn't want to have to know that. It's not because they were themselves hands on doing that. It was because they were systems down for three days, so found themselves really needing to investigate.

Adam Leventhal:Often, they're like networking questions that I find completely inscrutable, but seem happy with our answers.

Bryan Cantrill:Well and and I would say, like, never judge a book by its cover too in this regard. Adam, just as as you've been surprised, we have been surprised about the level of low level details that people care about. And it's always great when someone cares about something that we've thought a lot about. I feel like there have been a bunch of these examples. I mean, Steve, I think for us, one of the ones that really stands out is we were at a VC event, which is say which packed with venture capitalists.

Bryan Cantrill:And know, as we were discussing with, like, the kind of not great questions you get, you kinda have a low bar. And I was stuck in a coffee line next to a VC that looked like they were gonna go clubbing later. And I was just like, oh god. And, I kind of dreaded being in a conversation with him. And but I was like, I can't resist.

Bryan Cantrill:And he's kinda talking a little bit about oxide. And he's like, just please tell me you did something about a fucking neck. I'm like, what? Like, you know what a neck is? He's like, yeah.

Bryan Cantrill:Like, cabling these systems is awful. And I'm like, you spent time in a data center? Like, yeah. That's when I came up in the data center. Was awful.

Bryan Cantrill:And, like, you had all these miscabling, and I'm like, okay. Well, actually, we need to actually go show you the rack actually. And we we so we had an outside rack actually at that event. And it was pretty wild to have somebody you know, and never would have but, of course, like, a lot of people have felt this kind of pain. So I think we continue to be surprised about the people that have a great deal of empathy for

Adam Leventhal:what we've done. I thought this was a very interesting question. Someone wrote, I don't disagree that there's some fat margins in the cloud, but how is vendor lock in any different here? Companies could end up paying fat margins to Oxide too while still managing physical gear and plant.

Bryan Cantrill:Absolutely. And I think that that is something that we're very mindful of is that how do we and the tension is how do you deliver someone an integrated product and yet also alleviate some of the fears about being locked in? Because also, especially people that are coming from Broadcom, hey. I'm kinda coming out of a bad relationship over here. And, you know, how do I earn trust that you're not gonna do the same thing to me?

Bryan Cantrill:And that's a multifaceted kind of thing that we certainly, I think that being transparent about our company, but as what we've done, being open source is really important for that. Being very upfront about like, here's what our model is. Here's the economic model of this thing. Being very upfront about the fact that the software is built in and that you're gonna that when you buy a rack, when you get a support contract, software comes for we we will update the software, and then software will get better over time. But that's trust that really has to be has to be earned.

Bryan Cantrill:And so I think that it's it's a very legitimate question, but it's one that we've certainly thought a lot about.

Adam Leventhal:Yeah. Some of the questions came, I think, from your alts, Brian. And I was gonna read a few of those. Aside from the actual product, On The Metal and Oxxade and Friends are really great podcasts that manage to make programming topics entertaining and educational. Brian Cantrell is a wildly entertaining and knowledgeable host in this at the same time.

Adam Leventhal:His cohost and guests are great too, I guess.

Steve Tuck:And Cohost and guests are

Bryan Cantrill:great too.

Adam Leventhal:Too. And I attribute a lot of that to feeding off his energy and storytelling. Highly recommend, especially for Rust folks. Okay. Look.

Adam Leventhal:I I I I

Steve Tuck:was also wondering. I'm sorry. I'm sorry. But, like, I didn't see that second swipe coming. I said the first one of his co hosts and guests are fun too, But then to come back to the point again and be like, only because they feed off of his energy.

Adam Leventhal:Yeah. Yeah. Yeah. So that was a that that was a good one, Brian.

Bryan Cantrill:I doubt you doubt, Adam. I know that that was a very hurtful comment clearly, and that does not I I mean, I would just like to remind you that people at the office, when they meet me, they ask where you are.

Adam Leventhal:So I well, I've been I've

Bryan Cantrill:been on the other side of this plenty where

Adam Leventhal:No. That's yeah. Yeah. No. That makes sense.

Adam Leventhal:I got another one. Brian, you absolute legend. You have the best technical seminars I've ever watched and countless rewatched. Thank you for inspiring a generation of engineers. Best of luck with everything at Oxide.

Bryan Cantrill:That's gotta be my third Is

Steve Tuck:that b chasers? Yeah.

Bryan Cantrill:Yeah. Exactly. You you get to the number one fan. That feels like This is from

Adam Leventhal:a great handle, which is Keto Mojito. Terrific handle on Hacker News. That's cool. And then, you know, a little you you mixed it up and made made this one a little more incisive. You said, I always believed in Brian, but the day I heard the buzzword cloud repatriation, I know there was a market.

Bryan Cantrill:I I introduced some some grammatical errors and some punctuation, and I I just started trying to mix it up a little bit.

Adam Leventhal:LLMs have been a real boon for you laundering these these alts. No. For sure.

Bryan Cantrill:That's right. Yeah. That's right. Obviously, very flattering, but the and but I would also say that, like, on all of this stuff and I think people hopefully realize that it's been very much a team effort on all of these things. I think it is interesting that they keyed off of the buzzword cloud repatriation.

Bryan Cantrill:Something we have actually not used. I I mean, Steve, you are not wild about that term. The and

Steve Tuck:I think it I think it is. Especially when it gets used in a way to describe like, ugh, people are just trying to run off the cloud as fast as possible. And it just does the transformation cloud computing has been seminal to so many things in the last fifteen years because of its architectural properties and what it allows companies to do. And is not people running from modern technology and services. I think what's even more interesting is companies that are very large public cloud computing companies, customers, who need more than just that footprint.

Steve Tuck:It's not that they're trying to get off the public cloud, but they have a bunch of business use cases where they need to serve a lot more of the economy than just the public cloud economy. If they are a big data storage platform, their total addressable market is data people are putting into the public cloud. What are they how do they service, you know, the 95% of data from a very large bank or some other institution that's sitting on prem, and they need to expand beyond the public cloud. And I feel like cloud repatriation doesn't do that kind of broader, bigger, more important use case, service.

Bryan Cantrill:But, hey. You know, if that's what gets But otherwise,

Steve Tuck:it's fine. No.

Bryan Cantrill:No. To to there was a market, you know, we'll take it.

Adam Leventhal:Yeah. I just

Steve Tuck:I just thought you could have used a different word in your comment in Hacker News.

Bryan Cantrill:Yeah. Fair enough. Well well, listen. I you know, the LLM did this one. I just I've actually, you know, thanks thanks to Agetic AI.

Bryan Cantrill:I just actually hooked these things up and

Adam Leventhal:let them go. This one I thought was sort of interesting. It's Oxide is doing some great things, but there's only so much you can do with firmware tweaks. A CPU running any load at all is going to be is going to completely eclipse the power usage of everything else in the system. Incremental improvements from things like more efficient fans and reducing the number of power conversions is great, but the power draw from the CPUs or GPUs is on another level.

Bryan Cantrill:There is truth to that. I mean, that's obviously like indexing on one aspect of the the product, namely efficiency. And there is certainly truth to that in that, like, yes, the CPU is what is is consuming the vast majority of power, but there it's also, like, it's not telling the full story in that you I mean, as we've said repeatedly, like the cooling, especially air cooling, it is an issue. And with especially when you've a system that's not really designed holistically for it. But then also just the ability to not have observability about where the draw is happening, I think is more acute issue that where, like, you just can't even answer the question Yeah.

Bryan Cantrill:About how much is going. And I I feel I mean, I remember when we started out, and I I can't even if we talked about this in our episode with Robert or not, Adam, but, like, the the one of the questions that we you know, as we were starting with this PMKW rack power budget, which now seems kinda quaint in the the the world of AI, we just we wanted to know the draw of a dim and which feels like, like, how hard is it to answer that question? It's like, oh, very hard. It really depends on what that DIMM is doing. And then, like, the the number can go from, like, a watt to, like, 12 watts.

Bryan Cantrill:And, you know, you kind of view that 12 watt, you know, or that kind of that upper end use case as being pathological, but you actually don't know on a running system because, like, that stuff adds up. Like, s QSFPs add up. The the u dot two drives add up for sure. Those things can I mean, there there's a computer in every one of those drives with DRAM and so on? The DIMMs add up.

Bryan Cantrill:So it's not I mean, I yes. The CPU is the is the the largest source of of draw and heat in the system, but this really adds up. And if you don't have the observability to know what's what, you don't actually know. So I I think that that's as as important as anything.

Steve Tuck:Yeah. And even even beyond that, it's like if you are trying to take measure of how much work you can get done per watt, there's another important vector here, which is utilization. How much of the system that you're running you actually are utilizing at any one time? And, unfortunately, if you were to ask, an enterprise CTO today what their average utilization is in their environment, it's like 25%. So in addition to lower level system energy efficiency, the orchestration, how you know, how you are doing placement, how you are opening up resources, how you are turning down resources, all that orchestration that the cloud hyperscalers are very, very good at so they can run at very high utilization, back to the aforementioned margins, that that is a really important part of getting much more out of the footprint that you have, and that's all in software, Upstack software.

Adam Leventhal:So a bunch of nice congratulations from one from John Masters on Twitter, from Adam Jacob. Ryan Dahl says, I'm impressed that there's no mention of AI or LLM in the announcement. So Thank you, Roy. Thank you.

Bryan Cantrill:Yeah. That sounds very deliberate. Yeah. From from from Rye, for sure, it's a compliment.

Adam Leventhal:There you go. I know.

Bryan Cantrill:I I totally appreciate that. Obviously, we're worked with the we worked with Rye and The Joint. The that was very deliberate, actually. It's not mentioned it at all. Not because there there isn't applicability, just because I I think that, you know, there is and I god, Steve, we saw this especially on the series a announcement being like, you know, as we're talking about, you know, what does the press release look like around that?

Bryan Cantrill:It's like, can't you guys say anything about AI? It's like, do we like, can't we just talk about what we built actually? And then and and there's applicability. There are absolutely things we can say about it, there are things we can say about lots of different verticals. And, anyway, so, yeah, I I appreciated that.

Bryan Cantrill:I'm thinking that is price.

Adam Leventhal:I'm sure you saw this one from Kirill. It said, I work with their product, and I was a 100% sure that they had raised just a bit less than $500,000,000. Doing what they did in six years for $89,000,000 is insane, literally insane. Think he does it literally.

Bryan Cantrill:You wanna accuse me of having alts, that's the alts to accuse me of having. The yeah. It is. I really appreciate that because I feel that what we and, you know, someone else had asked, like, how much capital have you raised total? And that kinda answers that question.

Bryan Cantrill:This more than doubles the capital we have raised. And, yeah, that's a real testament to the team. And I think we've been careful and prudent without being I would like to say, I would like to believe that we've been thrifty without being frugal, that we've hit some good. And I think the risks that we've taken have all been prudent. So yeah, I think I'm really proud of what we built as a team on the capital we've raised.

Bryan Cantrill:And I do think it's important that people realize that we're not. Someone had asked earlier, it's like, does this mean you're going be hiring a lot more? Yes, it absolutely does. But we're also not like, we don't have a preconceived notion of sometimes companies raise a lot of money and they lose track of what kind of what got them there. And you can absolutely expect that we're going to continue to hire as carefully as we have hired.

Bryan Cantrill:And we're going to continue to be very prudent about the way we expand the company because we've got our shot and that's what this capital is about. And I can't remember Steve or Adam if we've said the comment here. But one of the comments that Steve and I got that really resonated with us was from a veteran entrepreneur and technologist who we had pitched early on Oxide, came to Oxide a couple of years ago, saw what we built. And I looked around and be like, god, it'd be a real shame to fuck it up now. And it's like, yeah.

Bryan Cantrill:Yeah. I mean, I'll put it on the wall. It'd be a real shame to fuck it up now. So we've got our shot, but we are we're very aware of the fact that it is it's one shot, and we need to be very prudent about we we, on the one hand, need to expand in all these different dimensions, and the other hand, we don't wanna blow it. Yeah.

Adam Leventhal:There was this very sweet comment that, Brian, you you pointed out to me. Good for them. I used to walk my dog past their office warehouse in Emeryville. And when the weather was warm, they'd have the doors open and the giant server stacks just sitting there looking awesome. I guess it's not really a concern for someone who will steal something that looks like it would take a forklift to move.

Adam Leventhal:Anyway, I thought that was a sweet one.

Bryan Cantrill:I think that means they're on two of us.

Steve Tuck:Yeah. So they roll. But Oh, yeah.

Bryan Cantrill:They they do this is where we gotta give credit to CJ who, you know, on our operations team. You know, whenever we've got some whenever we've got some malpractice going on in the office, he's very good at being like, you know what? We're gonna get for these gates a lock. So the the posts are neglected to mention they're actually behind locked gates. So you can see them, but you actually you're gonna you could probably hop the fence, but you're gonna make a racket doing it.

Bryan Cantrill:Just come around and come around and ring the doorbell. I'll be glad to give you a tour. I mean just feel like and also that comment, if you saw the reply to that comment, then, like, expanded on how reckless it was for us to be, you know, like, begging for these things to be stolen or what have you. It's like, oh my god. Like, every Hacker News comment, we just cannot stay out of the gutter over here.

Bryan Cantrill:Yeah. I I did I I was a little surprised. You know what I was expecting a little bit more of that we got kinda none of? People going back to some of the skepticism when we first raised. I mean, we've been a number one hacker news story a lot at this company.

Bryan Cantrill:We were a number one hacker news story when we announced that we had raised, and we had, you know, a lot of skeptics. And no no one really going back to that thread revisiting those skeptics. It was more like just repeating exactly what those skeptics I just feel like, okay. I feel like we're it's gonna it's gonna it's gonna have six years and $189,000,000 later. It's gonna take a lot more than that.

Bryan Cantrill:I don't know. I mean

Steve Tuck:Call someone down on a a shoe bet. Yeah.